UAS Update with NSR Analyst Prateep Basu

In a recent report, Northern Sky Research (NSR) analyzes how unmanned aircraft systems (UAS) are evolving, along with their current and potential applications. As the number of in-service units increases, the demand for satellite capacity will grow. NSR Analyst Prateep Basu spoke with SatCom Frontier about the report findings and how the latest offerings from the satcom market will enable UAS.

Q: Can you briefly discuss the different types of UAS, and how they affect the overall demand for satellite bandwidth?

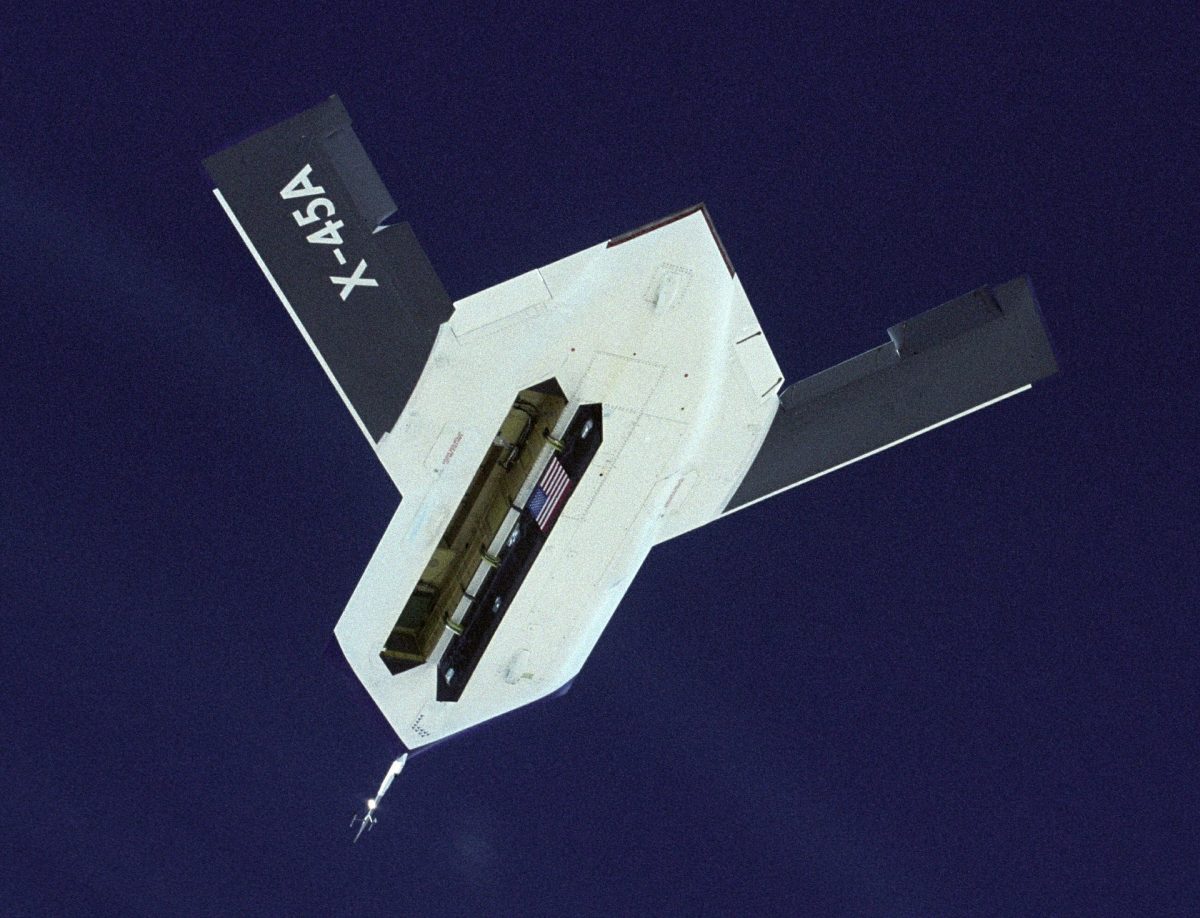

NSR studies two types of UAS in its report: High Altitude Long Endurance (HALE) UAS like the Global Hawk and Triton, and Medium Altitude Long Endurance (MALE) UAS like the Predator and Heron. This segmentation is based on factors like the range, endurance, and maximum ceiling height that these UAS can scale.

The larger HALE UAS can carry more payloads, resulting in greater bandwidth requirements for beyond-line-of-sight (BLOS) communications. However, their numbers are much smaller than MALE UAS, which are easier to build and cheaper to operate. But MALE UAS also cannot accommodate large ISR payloads due to airframe restrictions. Hence, NSR maps the demand for satellite bandwidth taking these factors into consideration.

Q: You talk about Artificial Intelligence (AI) in your recent report. Where does that fit in?

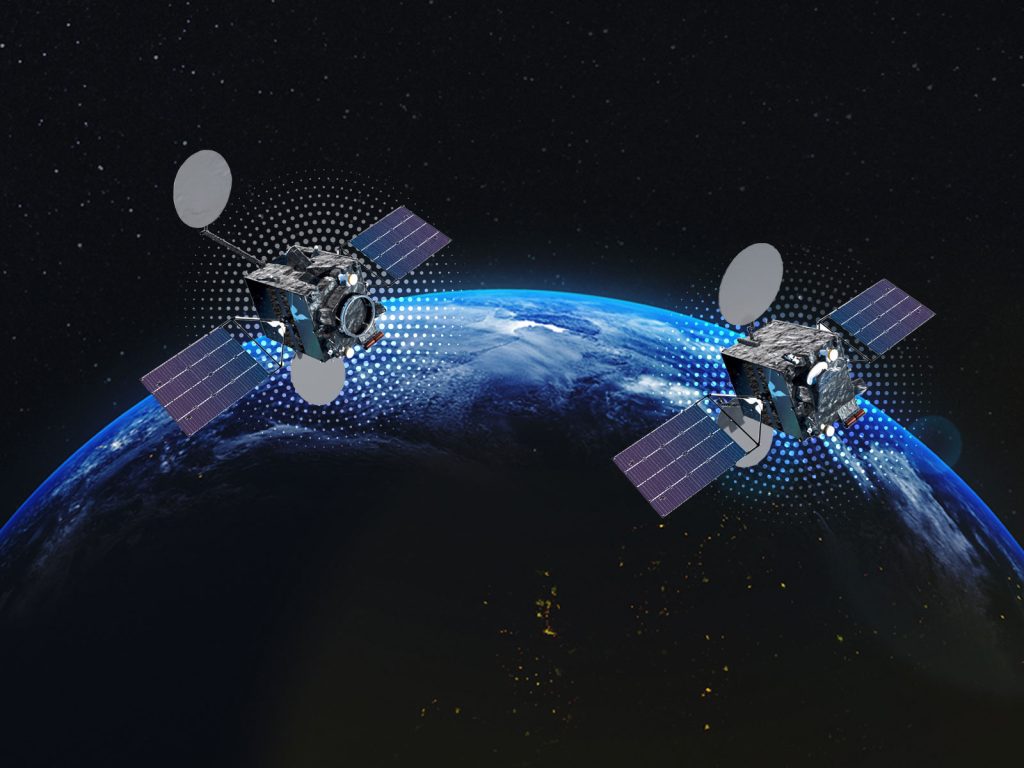

The satellite industry has been moving towards managed services from bulk capacity purchases by government agencies. This approach provides opportunities for satellite operators and service providers to add new solutions that could provide greater value to the end customer. Using artificial intelligence to map threats in real time is one of the areas that NSR sees has potential to enhance the service-level agreements on instantaneous bandwidth availability, which would result in greater retail revenues for satellite operators from the UAS satcom markets.

Q: How will new high-throughput satellite (HTS) platforms coming on line affect UAS, especially relating to smaller Class III?

The impact of HTS on smaller UAS operations would be mostly on the operational capabilities, since the higher throughput will enable more sophisticated payloads on these platforms. The increase in the bits/Hz, assisted by both these new HTS and UAS satcom terminals, will provide operational flexibility to the customers for tactical missions.

Q: How would a move towards more managed services, as opposed to straight bandwidth, affect the UAS market going forward?

As explained previously, managed services for UAS will result in greater flexibility for the customer as well as the satellite operator to keep costs under control and deliver a suite of services that previously had to be procured individually. Bundling capacity services with analytics services will boost the revenue potential per contract, as well as the win rate.

Q: Can you expand a bit on the non-military UAS market?

The non-military UAS market is still nascent and suffers from budgetary constraints. The emphasis on homeland and border security has increased the demand for UAS as a platform for surveillance. However, apart from the U.S., other parts of the world using UAS in civilian government applications are mostly using line-of-sight communication links. The penetration of satcom for BLOS communications can be expected with better price points for these services, which NSR expects HTS could enable.

Q: Anything else you see that will impact the UAS marketing in the near-term?

I think we will see a more collaborative approach between UAS airframe manufacturers and satcom terminal makers, right from the design phase onwards for the new UAS programs which are running globally. We have already seen this in the commercial aero satcom industry. This helps meet client expectations on inter-operability for BLOS communications for a longer time horizon. Having multi-band terminals that can fit in most UAS airframes will also improve the market for UAS satcom.