The Top 5 Hidden Costs of Today’s DoD Space Programs

I’ve worked in the space industry for many years serving both commercial and government customers. One of my most consistent frustrations is hearing how much more expensive it is for government to purchase commercial satellite services or to host USG payloads on commercial spacecraft rather than using USG-owned space assets. No matter how often this is debunked, these misconceptions persist.

Hidden Cost #1 – Budget Process

One big reason for added (but avoidable) expense has been well documented in the trade press – the practice of government customers using short-term leases and spot market purchases. Whether government or commercial, making long-term commitments (bandwidth or hosting) will always be rewarded with lower rates. Since the commercial world now (and will likely for the foreseeable future) provides the majority of the satcom used by the DoD, why can’t the USG plan ahead and save money?

A large progress roadblock has to do with how the USG is required to purchase commercial services. Procurement law forbids the USG from paying (or committing to pay) for services in advance of the year it is actually delivered. Thus the cost savings associated with a multi-year commitment to procure bandwidth (like those enjoyed by a commercial customer) have been outside the scope of what the USG has been able to do. SMC’s recent “Pathfinder” program is a creative attempt to dig out of this acquisition hole.

Annually, funding for USG discretionary programs (everything DoD for example) needs to go through the expensive and time-consuming budget approval process. This means that every year DoD programs, regardless of criticality to the security of the U.S., are subject to restructuring or cancellation. Big government contractors employ an army of lobbyists to ensure that their programs survive this process. The cost of this intensive activity (by both the USG and the prime contractors) is tacked onto the “real cost” of each program. Additionally, costs associated with possible execution of an early contract termination are included in budget – all adding to the taxpayer burden.

Hidden Cost #2 – Price Escalation

USG Programs are bid to win – often under other than fixed price acquisitions, driving unrealistically low bid prices with the assumption that requirement changes, budget-driven schedule delays, and scope creep will allow the prime contractor to “get well” over the life of the contract and achieve attractive returns. No surprise that cost overruns are so common on DoD space programs.

The fact is, a hosted payload solution is typically dramatically less expensive than a dedicated government satellite program. But often it doesn’t appear that way in government cost estimates. Contracts for hosting USG payloads on commercial satellites are firm fixed price. Different from many USG contracts, the commercial operator is legally obligated to fulfill its commitment to host the payload for the amount stated in the contract. This means that the commercial operator is at risk to actually lose money if they fail to perform as expected.

In contrast, contractual overruns for almost every USG defense system has resulted in a history of restructured programs and need for establishment of Nunn McCurdy legislation to “stop the bleeding”. Defense contractors and USG agencies habitually underbid and underfund programs, respectfully, in order to have a better chance of securing initial and continuing program support from Congress.

Hidden Cost #3 – Supporting Infrastructure

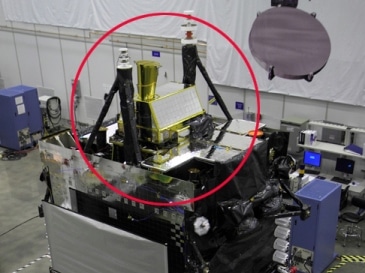

Commercial hosting service costs are end-to-end through end-of-life. For example, an imaging payload could be delivered GFE at one end of the contract and the digital data from that imager is delivered directly to the USG at the other end. The commercial contractor is responsible for EVERYTHING in between. This includes integration and test of the payload, the launch, the orbital operations to position the hosted payload, operations and data relay.

Teleport and cost of operations (i.e. operations staff) are included in the commercial firm fixed price. By comparison, these costs are usually “hidden” for USG owned/operated spacecraft as the dollars come out of a different budget. Additionally, launch of the commercial hosted payload is not subject to the trials and tribulations we read about (almost weekly) with respect to EELV. Unlike government estimates, hosting even includes the cost and liability of disposing of the payload at the end of host satellite life.

Hidden Cost #4 – Schedule Delays

Commercial services means services will be delivered when expected or in the case of hosted payloads, place on orbit consistent with the initial contract.

It is said that “time is money” – and this could not be more true than for the commercial satellite business where huge investments are REQUIRED to start delivering returns as quickly as possible. On the government side, it is not uncommon to see the launch of a government satellite slip by many years from the original plan.

Commercial satellites are built “just in time” to allow rapid return on investment while still maintaining manageable risk. Satellite production/launch schedules usually include “some” margin to accommodate a possible launch failure investigation or construction mishaps, but in general this margin is no more than 6 months. Six months is not a lot of time – but can make the difference between a company keeping or losing customers, making or not making “their numbers”, or maintaining credibility with investors.

In contrast, a six month schedule delay for a USG program (relative to the original proposal) does not have the same implications on the government side. (This point was documented very clearly in a 2012 report from AT Kearney.) What does a year program slip (from original contract) mean in the government world? Most likely, a delay of that duration would likely be taken as a sign everything is going extremely well!

There simply isn’t any significant penalty to the USG associated with late delivery of a USG payload. In fact, a slower-than-expected USG program usually means that the prime contractor is making more money and providing job security for its workforce. There most certainly is a cost (though never quantified) to the USG program end user/warfighter.

Hidden Cost #5 – Not Fully Leveraging Commercial Opportunities

A successful hosted payload “demonstration” might only last for 1 – 3 years. A hosted instrument might use a “leased” commercial transponder to relay data to the ground. When the demonstration is over, the hosted payload can be shut down, the transponder re-purposed to commercial use by just commanding a switch, and the operational support for the hosted payload absorbed back into commercial operations.

In this example the USG was not required to “purchase” the transponder. The cost to the USG stops when their usage stops. If, at some later time, the USG decides to power on the hosted payload for either more testing or to bring the payload into some sort of operational service, costs are not incurred by the USG until the commercial operator actually “does something” to earn that revenue.

I hope these five considerations provide some insight into the cost effectiveness of commercial services and commercially-hosted payloads versus status quo procurement processes. The commercial space industry has been supporting the DoD for over 20 years, and our performance is second to none. If cost comparisons are to be made, let’s make them honest ones.