The Cost of COMSATCOM vs. MILSATCOM

Recently a study conducted by the DoD came out purporting to show that commercial satellite bandwidth is more expensive than bandwidth provided by military-owned satellites. Here’s a story from Space News on the report.

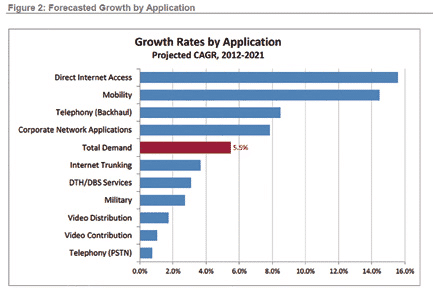

Back in August, my colleague Bryan Benedict addressed such cost comparisons in an insightful SatCom Frontier post entitled “The Top Five Hidden Costs of Today’s DoD Space Programs.” The perception that COMSATCOM is more expensive than capacity on military satellites is a long-standing one. However, it is unclear what went into the numbers in the report. We believe the total cost of MILSATCOM as described in the report is incomplete at best, while the cost of commercial capacity is computed using the most costly method of procurement. Without greater transparency into the numbers, it is difficult to make a more detailed assessment.

We do believe that if the DoD procured commercial capacity using a long-term, baseline-requirements approach, the costs would be lower than those calculated in the report for commercial service. In fact, the report itself urges the DoD to explore longer-term leases. This would allow the DoD to save money while allowing the commercial satellite industry to include long-term DoD requirements into its future satellite plans.

We have been consistent in advocating that the DoD develop accurate and transparent comparisons of the cost of commercial vs. the cost of military satellites, and this latest report does not change our view. Beyond the cost issue, we were pleased to see that the report highlighted, as we in the industry have been saying for some time now, the problems caused by the military’s decentralized approach to acquiring commercial satellite services.

By its own admission, this approach prevents military planners from developing accurate demand predictions, impedes centralized, multi-year acquisition, and prevents the DoD from managing MILSATCOM and COMSATCOM as a holistic capability. This approach also impedes developing accurate cost comparisons between the two, which is ironic considering cost claims.

Like the DoD, we believe a single functional manager of the military’s total use of satellite services is needed. This organization could drive all aspects of SATCOM from architecture development to acquisition of services.

We will continue to assist the DoD in its efforts to centralize SATCOM management and procure it more efficiently. This entails working with lawmakers to acquire appropriate authorities for multi-year procurement and exploring, mostly via the DoD’s own Pathfinder efforts, ways to invest early in commercial capability to meet future requirements.

In a word, we believe the many advantages of COMSATCOM will prove to be decisive: global, flexible access due to many launch opportunities; technology refresh due to rapid acquisition timelines; and commercial advances in and adoption of layers of protection to provide assured communications (like new protected waveform technologies, spot beam HTS architectures, and wider transponders). Overall, commercial SATCOM will provide the DoD with greater information assurance, survivability and resilience.

Disagreements about cost models will not distract us. We believe the true value for our partners is moving to commercial for all wideband. And we will assist in any way possible along the way.

For an explanation of seven specific ways the DoD can become a better buyer of commercial SATCOM, see our recent paper here.