Taking HTS from Promise to Full Potential

By Stephen Spengler, Chief Executive Officer

Over the course of the past year, I have talked enthusiastically about the many growth opportunities present in the delivery of telecommunications services. However, I have also expressed concern that our segment of the industry is lagging others in  aggressively adopting new technologies and business models that will lead to a greater role for satellite in the telecommunications landscape.

aggressively adopting new technologies and business models that will lead to a greater role for satellite in the telecommunications landscape.

We’ve covered some new ground in the last twelve months. But the question we should be asking ourselves is, “Are we moving quickly enough?” In some areas, we have seen unprecedented innovation. New high-throughput satellite platforms are emerging and, as a result, spawning the introduction of new services and business models. Despite the different models coming to market, I still hold to the premise that I first discussed a little over a year ago: in order to drive growth and make the world more digitally inclusive, we need to deliver higher performance, improve the economics of satellite solutions, and simplify access to our technology.

The definitions of HTS performance vary widely. Some will define performance by frequency band, or by the availability of capacity in a certain band, or even by attributes associated with a particular orbital constellation. What is missing from this conversation is a customer-oriented definition of performance. We can speak in ‘bits and bytes’ all we want, but when it comes down to performance, the question that needs to be asked is whether you optimize an HTS platform for total throughput at the satellite, or throughput to the user terminal? Or put more plainly: do you optimize for the satellite operator, or for the customer experience?

For our business, we believe that focusing on throughput to the customer’s dish is the appropriate measure, because this metric describes the level of performance/efficiency experienced at a specific customer location.

The fact is that we don’t have to deal in hypotheticals any more. Intelsat EpicNG is now here, the first truly high-throughput global platform. Our first Intelsat EpicNG satellite, Intelsat 29e, entered service in late March of this year. Our second one, Intelsat 33e, successfully launched in August and will enter service following orbit raising and testing. Our experience with our customers on Intelsat 29e demonstrates that the Intelsat EpicNG design is exceeding expectations. Without having to change out their existing hardware, customers are receiving higher performance at discrete user terminals, up to 2.5 bits/Hz. This represents a substantial improvement, 1.65x by some estimates, over the efficiency of a traditional satellite, and customers are experiencing up to 5 bits/Hz as the Intelsat EpicNG ecosystem partners introduce higher-order modulation technologies on the ground.

Further, the digital payload on Intelsat EpicNG allows customers to both multi-cast and broadcast, which is critical for aeronautical, maritime, cellular backhaul, connected car and IoT applications. The platform’s higher modulation capabilities enable maximum uplinking speeds. Customer experience at the user terminal is where performance should be measured.

Many may believe that HTS alone will be the ‘magic’ that unlocks new applications for our sector. We think differently. In 2015, I cautioned that in order to unlock new applications, we will need more than just higher performance. We will also need to deliver better economics and simplified access to our solutions.

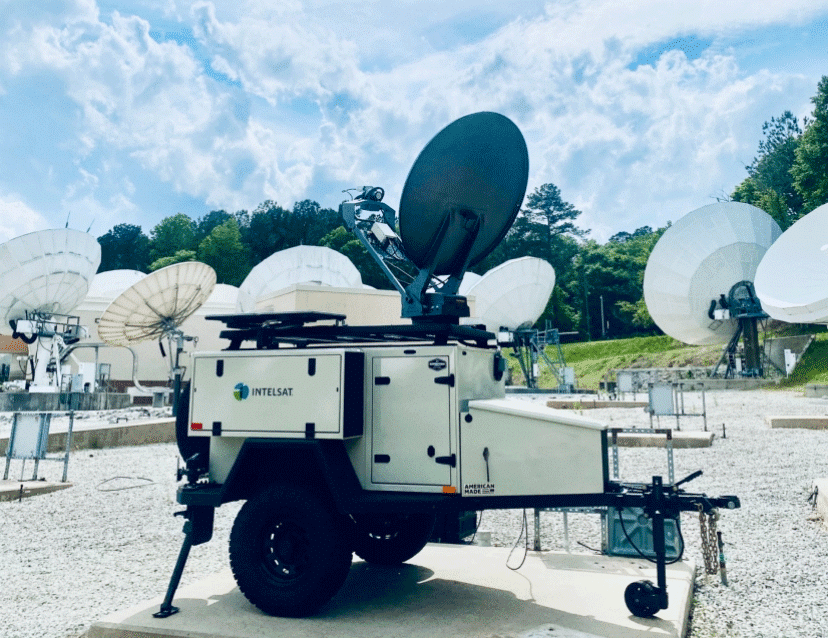

Delivering better economics isn’t something that will be sourced exclusively from the satellite sector because we see opportunities to leverage innovations from the broader telecom and tech sector. From accessing mass market production, to adopting different business models, the path to better economics will address every aspect of the acquisition and operational costs of implementing satellite solutions into network architectures. We are adopting more managed-service models in our business, such as IntelsatOne Flex and IntelsatOne Prism, to expand solutions based on shared hybrid satellite, wireless and fiber infrastructure. This will allow our customers to reduce capital expenditures and instead put the investment toward application development that will drive further traffic on their networks.

In the past year, the goal to develop simplified access has progressed, achieving many milestones on our way to production-ready technology. Innovative start-ups such as Kymeta and Phasor are advancing antenna technology with much smaller, less expensive and more flexible form factors that will open new addressable markets for satellite.

For example, Kymeta’s flat-panel antenna, which incorporates technology already mass produced, can be installed into the rooftop of a car on the assembly line, significantly easing market adoption, optimizing the use of the satellite and delivering real economic advantages for car manufacturers and value for their customers. We’ve tested Kymeta’s technology with our satellite fleet for the connected car across the continental United States and with maritime applications.

Our customers are eager to use these antennas, as evidenced by the enthusiasm surrounding the demonstrations over this past year. This technology has the potential to open large markets where satellite services were once too expensive or difficult to use, such as the connected car, agricultural applications or fishing vessels.

Another example is the work that Gogo has put into its 2Ku antenna, investing in access technology that will differentiate the company’s offering. The 2Ku antenna is optimized for form factor and performance, increasing the bits/Hertz available to passengers and operational applications.

As the industry anticipates these, and other new antenna technologies, more needs to be done to drive ground innovation forward. In order to capture the emerging opportunities in the IoT and M2M sectors, we need much cheaper, smaller devices — not in the future but right now — so that we can participate in these fast growing markets.

Today’s broadband connectivity opportunity is vast. Big challenges need many solutions. A one-technology-fits-all mentality will not address the market requirements in a way that shows we want to provide the best possible solution to our potential customers.

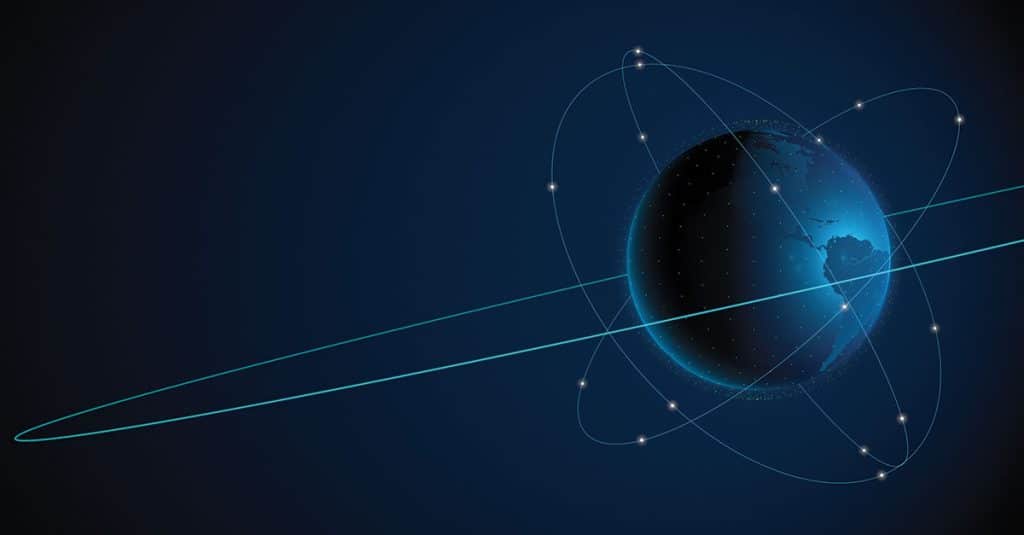

We need to have interoperable and flexible architectures that allow our customers to integrate satellite technology into their own networks and complement fiber or wireless technology when needed. We shouldn’t rule out one orbital plane or frequency band, but instead think of how we can harness the strengths of satellite technology to the benefit of our customers.

That is what led us to partner with OneWeb and why we believe it is critical that it be interoperable with our fleet — not just compatible. Customers will be able to dynamically access both the Intelsat and OneWeb constellations from a single integrated satellite terminal. This provides a clear path to building on the robust ecosystem that is forming around Ku-band as the spectrum of choice for enterprise and carrier-grade solutions. Some question the idea of a fully interoperable GEO/LEO partnership, but in our view, that is what the future demands and we are intent on pushing innovation to realize the full commercial potential of our space-based network.

It goes back to what I said at the beginning: the satellite sector needs to deliver better economics and simplified access. Customers need to have choice — of technology, of hardware and of orbital plane. We must continue to push for innovations that take us beyond our traditional way of doing business. Our mission is to bring innovative solutions to our customers to enable them to grow their services in new and emerging markets. Pursuing performance, better economics and simplified access gets us closer to achieving our goal.