Supporting the Expansion of Regional Banking and Economic Growth in Africa with High Throughput Satellite Networks

Jean-Philippe Gillet, Intelsat’s Vice President and General Manager, Broadband

Many growing businesses would like to expand their operations to capture more revenue opportunities, and these owners often take it for granted that the banking services necessary for facilitating payroll and other financial activities are available everywhere in their respective country. But that is not often true in many parts of the developing world, particularly in Africa. The banking industry in sub-Saharan African nations is so thin that people living there have one of the lowest rates of access to financial services anywhere in the world. The World Bank reported that in 2014, only 34% of the population have an account at a financial institution, with Kenya leading the region at 55% a figure still well below the rate of Western and European countries. Financial services for businesses and consumers are the foundation of economic growth, and restricted access to loans, payroll processing, or payment systems slows commercial activities.

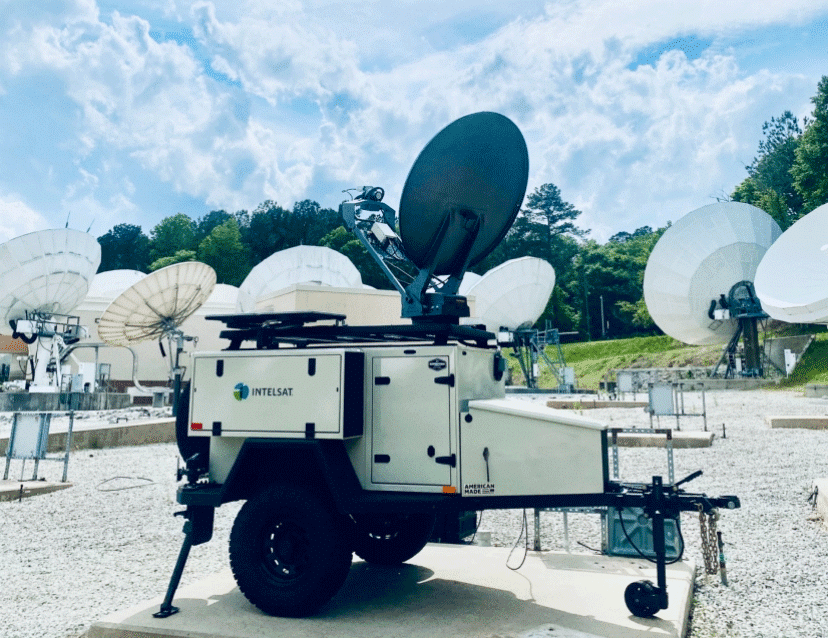

Regional banking groups are working hard to change that. One of the largest, Ecobank Transnational of Togo, has more than 1,300 branches in 36 countries, bringing banking to more than 10 million customers. An Ecobank subsidiary, eProcess International, provides IT services to the branch network, which also includes nearly 3,000 ATMs and 13,800 point-of-sale machines. Large parts of this network are supported by wide beam C-band services on the Intelsat network.

eProcess recently upgraded the Ecobank network with services from Intelsat 35e, an Intelsat EpicNG high-throughput satellite that will deliver the additional bandwidth Ecobank needs to meeting growing demand across its pan-African network. Ecobank is using the C-band spot beams on Intelsat 35e to expand and strengthen its corporate banking services throughout Africa and address increasing transaction volumes for its customers. Due to the backwards compatibility and open architecture of the Intelsat EpicNG network, Ecobank was able to easily integrate the HTS services into its operations and saw a 30 percent throughput increase with minimal investment in site hardware.

Enhancing satellite connectivity to deliver more throughput in a simpler, cost-effective manner is vital for Africa’s banking and other enterprise sectors in order to support economic growth in many of the continent’s nations. The global economic boom of the early 2000s spurred business activity in sub-Saharan Africa, but the decline in oil and other commodity prices over the past decade has slowed the economies of resource-exporting nations. But the rest of sub-Saharan Africa is doing better, achieving a growth rate of 4.4% in real gross domestic product (GDP) over the past five years, virtually the same as in 2005 to 2010, according to a report in the World Economic Forum on Africa.

The growth has come primarily from services, utilities and construction, which together contributed to 71% of real GDP growth, up from a combined 61% over the previous decade. The expansion of banking services plays a critical role in the growth of these sectors. The World Economic Forum report cites three trends that will sustain Africa’s growth over the long term:

The first is that the continent has a young population, which it called a highly valuable asset in an ageing world. By 2034, demographers predict that Africa will have working-age population of 1.1 billion, the largest of any continent in the world.

Second, Africa is still seeing millions of citizens move from the countryside to cities, where job productivity is three times that of rural areas. Over the next decade, the United Nations predicts that an additional 187 million Africans will live in cities.

And third, technological innovations are enabling satellite providers to deliver improved Internet connectivity to more areas and drive wider use of smartphones without the need for governments or network operators to build expensive terrestrial fiber infrastructure . Smartphone penetration is expected to reach 50% in 2020, up from only 2% in 2010.

Ecobank, the largest regional bank in Africa, is a leader in helping sustain growth through loans to small businesses and financial services for their customers. The bank provides wholesale, retail, investment and transaction banking services to a range of clients, including governments, multinational corporations, non-government organizations, small businesses and individuals. The bank/institution also had established offices in Paris, London, Dubai and Beijing to serve the needs of its multinational customers. Other regional banks in Africa are expanding as well, including adding offices in other neighboring countries.

The economic growth across sub-Saharan Africa is uneven, with some countries outpacing others, but local growth coupled with direct foreign investment by multinationals dependent on the banking sector are fostering the continent’s continued vitality. Providing banking services to individual consumer and the small-to-medium-sized businesses at the heart of many economies depends on satellite connectivity like that being used by Ecobank.