2017 Trends in Media

Media Sector Stretches in 2017 as it Looks to Become All Things to All Viewers

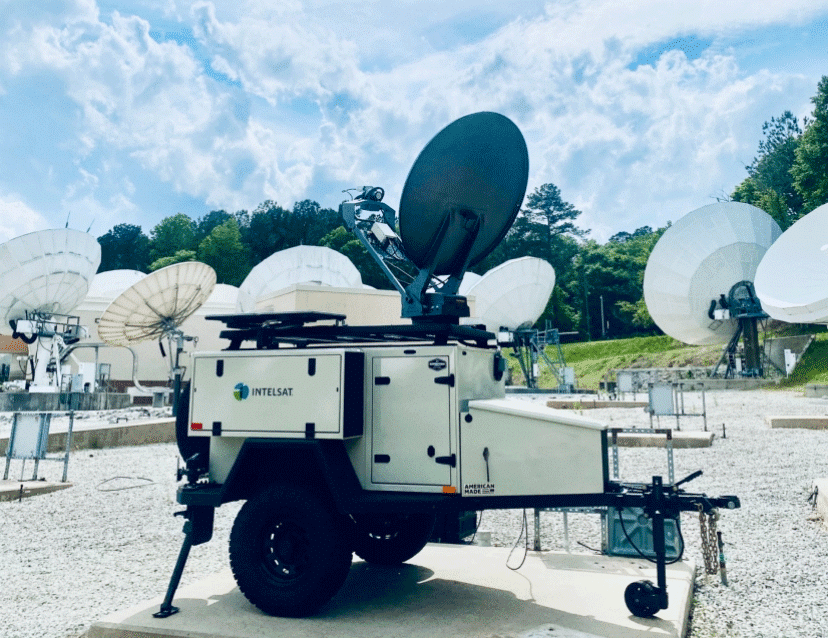

Peter Ostapiuk, Head of Media Product Services, Intelsat

The embrace of linear over-the-top (OTT) and time-shifted viewing along with the growing use of mobile devices by end users has been driving change in the media sector for several years. Viewing habits and market maturity differ from region to region, but the primary requirement for content owners and programmers alike remains the need to deliver content anytime, anywhere, in any format and to any device. We think the two biggest areas of change in 2017 center around the development of new business models that will monetize these alternate format content AND increased emphasis on improving quality and streamlining costs, despite the increasing multi-format complexities.

Traditional TV broadcasting remains strong, but as millennials continue to move toward linear online and video-on-demand (VOD) services, 2017 will see content creators and distribution companies continue searching for the best way to address demand of all of their viewers all of the time – while also searching for a way to better monetize these developments.

North America is currently the dominant market for OTT services but there is strong growth across Latin America, and some analysts see Asia Pacific becoming a top region for linear and VOD OTT services by 2019. Online video distribution pioneers such as Netflix and Hulu clearly have a head start in this arena. And Netflix has added the ability to download content for offline viewing and is also set to invest $6 billion on original content in 2017, while others such as Amazon are also putting in more effort to grow their subscriber base. But at the same time, we should also expect new competitors to appear with specialty content to try and grab a piece of this growing market.

The list of companies entering the linear OTT sector will expand as well, with new offerings coming from big-name global media players and regional providers. In the linear market, AT&T launched its DirecTV Now service to much fanfare in 2016 and other big names such as Facebook, Hulu and YouTube plan new content offerings in 2017.

Some of this migration to linear OTT and VOD is driven by the cord cutters, who are not necessarily seeking out better services but simply looking for cheaper options. This continues to put immense financial pressure on traditional programmers that rely on the subscription and advertising model. Subscriptions for video streaming are the fastest-growing TV and video segment, projected to be a $12.5 billion dollar business by 2021 in the United States, and advertising dollars are also beginning to flow toward the digital platforms. Online TV Advertising is projected to be worth $40 billion dollars globally by 2020, which is about half the ad revenue for all of TV advertising, according to the Texas-based Diffusion Group.

The challenge for the media sector will be navigating this market fragmentation and develop ways to capture the share of this new revenue that makes up for any losses on traditional channels.

As the demand for delivering reliable, high-quality, linear OTT content increases, delivery networks are also coming under pressure in terms of service reliability and costs. Surges in OTT viewership for live events often lead to crashing, buffering, slow start-up time and significant latency compared to broadcast feeds. The Internet is not designed to accommodate these traffic surges and the resulting strain on the terrestrial networks translates to a poor viewing experience that creates low viewer engagement and subscriber churn.

The evolution of the media sector is accelerating – perhaps faster than many had predicted just a few years ago. We believe the traditional strengths of satellite broadcasting, combined with innovations and services Intelsat is delivering, will play a critical role in helping content delivery networks navigate this growth in OTT platforms and multiscreen viewing and will help companies make this transition smoothly and profitably.