Made for America

Why our market-based C-band proposal is impractical for other parts of the world

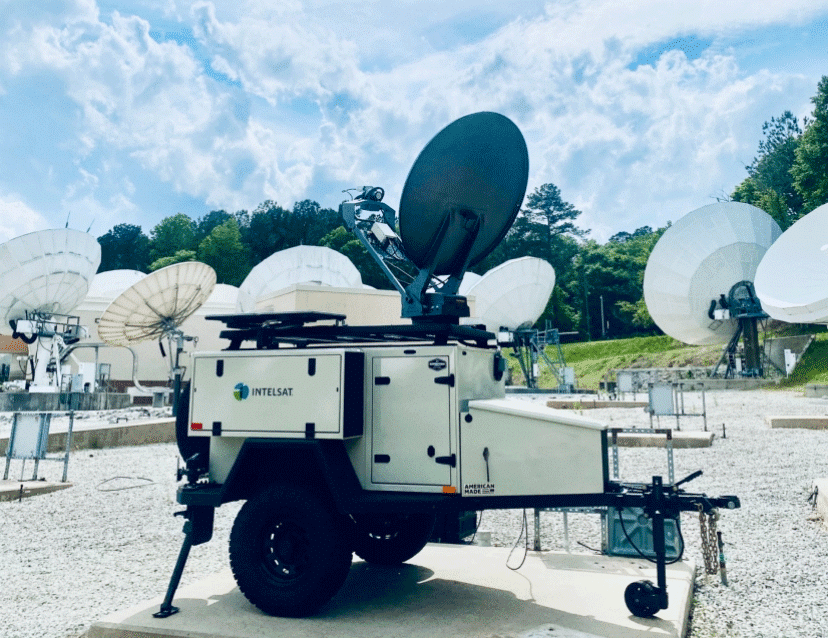

By Hazem Moakkit, Intelsat’s Vice President of Spectrum Strategy

For at least the past decade, Intelsat and other satellite operators have been urging regulators to protect C-band from encroachment by mobile network companies who want to use part of the spectrum to expand their services. So when we announced a collaborative proposal with Intel last month to enable joint-use of C-band spectrum in the United States, a lot of people wondered if we were opening a Pandora’s Box that would eventually lead to complete erosion of the use of C-band for satellite services around the globe.

First, let’s get one thing clear: Intelsat has not changed its view on the importance of protecting satellite operators’ ability to operate reliably in C-band. We will not compromise when it comes to continuing to provide highly reliable C-band services to our customers. We are the leading advocate that the services delivered in this band are crucial for media distribution in the U.S., and provide critical telecommunications globally.

There is a lot of confusion about the role of the International Telecommunications Union (ITU), in comparison to the role of individual nations and how they determine spectrum deployments. Generally, while the ITU sets the overall global spectrum allocations and establishes the framework for orbital rights, every country retains its sovereign rights to allocate spectrum and create regulatory frameworks according to that country’s particular priorities. Simply said, the ITU does not overrule or supersede a country’s sovereign right to allocate and regulate spectrum within its own territory.

That’s why we paid attention when the Federal Communications Commission asked for recommendations from the industry on how C-band spectrum could be shared by the wireless community to accelerate the deployment of 5G in the U.S. It was clear to us that the regulatory landscape and the market forces have changed in such a way that a new type of response was needed. Far from undermining the satellite industry’s right to C-band, we think our market-based proposal is the best way to address the unique landscape and regulatory environment regarding C-band use in the United States.

With our proposal, satellite operators can continue to deliver the highest quality service to our media and telecommunications customers in the U.S. Our suggestion of joint-use, enabled by satellite operators collaborating to clear portions of the 3700-4200 MHz band is only relevant to the U.S. given the uniqueness of the regulatory landscape. Here’s why:

- C-band Fixed Satellite Services (FSS) in the U.S. is predominantly B2B and is dominated by two U.S.-licensed satellite operators. Our market-based proposal is predicated upon the fact that the C-band FSS market in the U.S. is largely served by two U.S.-licensed satellite operators that control over 90 percent of all capacity, serving business to business applications. In contrast, C-band services in other countries are quite fragmented across many satellite operators that are licensed by multiple administrations. This makes our proposed U.S. approach impractical in other regions, where the jurisdiction over satellite operators and services provided is largely disjointed. Yet, it is important to note that our proposal ensures that all FSS operators can continue to have access to the C-band spectrum in its entirety.

- The rest of the world has already identified the 3.4-3.6 GHz band for mobile. In the U.S., 3.4-3.7 GHz is allocated to federal use (government) and to the newly minted Citizens Broadband Radio Service. In contrast, for the rest of the world, the train has already left the station. The 3.4-3.6 GHz band has already been identified for mobile-use, while Europe has gone as far as allocating the 3.8 GHz band. In other words, the rest of the world has already made mid-band spectrum available for mobile service, unlike the U.S. Therefore, the risk of contagion is quite low.

- The economics of using C-band for 5G rollout only works for densely populated areas. When it comes to mobile service, C-band is considered to be a capacity band, not a coverage band. It is primarily used to manage capacity issues in densely populated areas were the economics support densification of mobile network deployment. Some other parts of the world still rely on 2G and 3G services, and the challenge is more about coverage than capacity. According to the GSMA, 2G technology still accounts for 58.5 percent of the world’s mobile connections. In these regions, the economics likely do not support 5G roll-out, let alone ubiquitous deployment in C-band. The FCC’s Notice of Inquiry was posed to address unique U.S. market conditions, which is why we responded with a proposal that provides joint-use spectrum in key urban clusters, where increased demand will require additional spectrum for densification.

- Many countries have invested substantially in C-band infrastructure to support social and welfare programs, thus the economics of joint-use are not viable. In much of Asia, South America, and Africa, C-band is relied upon for a broad range of services. Rain patterns and other factors have resulted in significant deployments of C-band services for vital communications and video transmissions by national/government-affiliated organizations, as well as commercial, satellite operators. The use of C-band in the U.S. is largely B2B, whereas the use of C-band in many other countries supports vital communications such as fundamental social and welfare programs. Therefore, governments would be unwilling to compromise their ability to deliver these fundamental services to their citizens. In these regions, they have, for the most part, already identified other spectrum for mobile use.

Applying the concepts of our U.S.-based proposal to other nations is like trying to fit a square peg in a round hole. We designed a solution that leverages the unique U.S. environment to address our regulators and lawmakers’ clear objective: expanded use of C-band spectrum by terrestrial operators in order to accelerate the deployment of 5G.

The satellite industry, with ground and space assets that last decades, is defined by its ability to envision the future. We haven’t gotten to where we are today by ignoring changing technology and shifts in the markets we serve—we are known for leading with solutions that will be relevant for years to come. Making portions of the C-band satellite downlink spectrum available for 5G joint-use in the U.S. is a challenge—and opportunity—that is unique to the United States. Our proposal should be viewed solely through that lens. To do otherwise allows for distortion of the facts.