Intelsat Announces Exchange Offer for Certain Notes of Intelsat (Luxembourg) S.A.

Luxembourg, 20 December 2016 – Intelsat S.A. (NYSE: I), operator of the world’s first Globalized Network, powered by its leading satellite backbone, today announced that its wholly-owned subsidiary, Intelsat (Luxembourg) S.A. (“Intelsat Luxembourg”), has commenced, subject to the terms and conditions set forth in a confidential offering memorandum (the “Offering Memorandum”), a private offer to exchange (the “Exchange Offer”) its 6.75% Senior Notes due 2018 (CUSIP No. 458204 AN4) (the “2018 Lux Notes”) held by Eligible Holders (as defined below) for newly issued 12.50% Senior Notes due 2024 (“2024 Lux Notes”).

For each $1,000 principal amount of 2018 Lux Notes validly tendered at or before the Expiration Time (as defined below) and not validly withdrawn, Eligible Holders of 2018 Lux Notes will be eligible to receive $1,000 principal amount of 2024 Lux Notes. Eligible Holders whose 2018 Lux Notes are accepted in the Exchange Offer will also receive a cash payment equal to the accrued and unpaid interest in respect of such 2018 Lux Notes from December 1, 2016, which is the most recent interest payment date, to, but excluding, the Early Settlement Date or Final Settlement Date (each as defined below), as applicable, provided, aggregate cash payments to Eligible Holders who tender their 2018 Lux Notes after the Early Delivery Time (as defined below) and who in exchange receive 2024 Lux Notes on the Final Settlement Date, will be reduced by the amount of interest accrued on the 2024 Lux Notes received by them from the Early Settlement Date to, but excluding, the Final Settlement Date.

The 2024 Lux Notes will mature on November 15, 2024. Interest on the 2024 Lux Notes will accrue at the rate of 12.50% per annum and be payable semi-annually in arrears on May 15 and November 15 of each year, commencing on May 15, 2017. On or after June 1, 2017, Intelsat Luxembourg may redeem all or a portion of the 2024 Lux Notes at any time at a price equal to 100% of the principal amount of the 2024 Lux Notes redeemed, together with accrued and unpaid interest to, but excluding, the redemption date. Prior to June 1, 2017, Intelsat Luxembourg may redeem all or a portion of the 2024 Lux Notes at any time at a price equal to 101.688% of the principal amount of the 2024 Lux Notes redeemed, together with accrued and unpaid interest to, but excluding, the redemption date.

The 2024 Lux Notes will be Intelsat Luxembourg’s senior unsecured obligations, ranking equally in right of payment with all of its existing and future senior indebtedness and senior to its existing and future subordinated indebtedness. The 2024 Lux Notes will be effectively subordinated to Intelsat Luxembourg’s existing and future secured indebtedness to the extent of the assets securing such secured debt. The 2024 Lux Notes will also be structurally subordinated to all of the existing and future liabilities of Intelsat Luxembourg’s subsidiaries, including the liabilities of Intelsat Connect Finance S.A. (“ICF”) to be incurred in connection with the exchange offers previously announced on December 7, 2016 (the “Prior Exchange Offers”) and the liabilities of Intelsat Jackson Holdings S.A. under its Secured Credit Agreement and existing notes.

The Exchange Offer will expire at 11:59 p.m., New York City time, on January 19, 2017, unless it is extended or earlier terminated by Intelsat Luxembourg. In order to participate in the Exchange Offer, Eligible Holders must validly tender their 2018 Lux Notes at or prior to 11:59 p.m., New York City time, on January 19, 2017, unless extended by Intelsat Luxembourg (such date and time, as the same may be extended, the “Expiration Time”). Intelsat Luxembourg expects to conduct an early settlement of the Exchange Offer with respect to 2018 Lux Notes validly tendered and not validly withdrawn prior to 11:59 p.m., New York City time, on January 4, 2017 (the “Early Delivery Time” and the date of such early settlement, the “Early Settlement Date”), and a final settlement promptly after the Expiration Time (the “Final Settlement Date”).

The following table sets forth certain key dates of the Exchange Offer. Further information may be found in the Offering Memorandum:

| Key Date | Calendar Date |

| Launch Date……………………… | December 20, 2016 |

| Early Delivery Time……………. | 11:59 p.m., New York City time, on January 4, 2017, unless extended or earlier terminated by Intelsat Luxembourg. |

| Early Settlement Date………… | Promptly after the Early Delivery Time, and expected to be the second business day after the Early Delivery Time. The Early Settlement Date is currently expected to be January 6, 2017. Intelsat Luxembourg reserves the right, but is under no obligation, to elect to have an Early Settlement Date. |

| Withdrawal Deadline…………… | 11:59 p.m., New York City time, on the date of the Early Delivery Time, unless extended or earlier terminated by Intelsat Luxembourg. |

| Expiration Time…………………. | 11:59 p.m., New York City time, on January 19, 2017, unless extended or earlier terminated by Intelsat Luxembourg. |

| Final Settlement Date…………. | The final settlement date is currently expected to be January 20, 2017. |

Intelsat Luxembourg reserves the right, but is under no obligation, to elect an Early Settlement Date.

The Exchange Offer is subject to customary closing conditions. Subject to applicable law and the terms set forth in the Offering Memorandum, Intelsat Luxembourg reserves the right to waive any and all conditions to the Exchange Offer, in whole or in part, and may do so, subject to applicable law, without reinstating withdrawal rights. In addition, Intelsat Luxembourg expressly reserves the right to extend or terminate the Exchange Offer and to otherwise amend or modify the Exchange Offer in any respect.

Tendering 2018 Lux Notes in the Exchange Offer will preclude tendering those 2018 Lux Notes in the Prior Exchange Offer for 2018 Lux Notes (the “Prior 2018 Lux Exchange Offer”), unless they are validly withdrawn from the Exchange Offer. ICF intends to tender into the Exchange Offer the $25 million of 2018 Lux Notes currently held by it, together with the additional 2018 Lux Notes acquired by it in the Prior 2018 Lux Exchange Offer and pursuant to the support agreements previously announced on December 7, 2016. It is anticipated that the 2018 Lux Notes acquired by Intelsat Luxembourg pursuant to the Exchange Offer will be cancelled.

The 2024 Lux Notes have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any other applicable securities laws and, unless so registered, the 2024 Lux Notes may not be offered, sold, pledged or otherwise transferred in the United States or to or for the account or benefit of any U.S. person, except pursuant to an exemption from the registration requirements of the Securities Act. Intelsat Luxembourg does not intend to register the 2024 Lux Notes under the Securities Act or the securities laws of any other jurisdiction. The 2024 Lux Notes are not transferable except in accordance with the restrictions described more fully in the Offering Memorandum.

The Exchange Offer is being made, and the 2024 Lux Notes to be issued pursuant to the Exchange Offer are being offered and issued, only (a) in the United States to holders of 2018 Lux Notes who are “qualified institutional buyers” (as defined in Rule 144A under the Securities Act), (b) in the United States to holders of 2018 Lux Notes not resident in Arkansas who are institutional “accredited investors” (within the meaning of Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act) and (c) outside the United States to holders of 2018 Lux Notes who are persons other than U.S. persons in reliance upon Regulation S under the Securities Act. The holders of 2018 Lux Notes who have certified to Intelsat Luxembourg that they are eligible to participate in the Exchange Offer pursuant to at least one of the foregoing conditions are referred to as “Eligible Holders.” Only Eligible Holders are authorized to receive or review the Offering Memorandum or participate in the Exchange Offer.

The Exchange Offer is being conducted pursuant to the Offering Memorandum, this press release and Intelsat S.A.’s or Intelsat Luxembourg’s other press releases related to the Exchange Offer (collectively, the “Exchange Offer Materials”).

Guggenheim Securities acted as Intelsat’s financial advisor for these transactions and Wachtell, Lipton, Rosen & Katz served as legal advisor.

Questions regarding the Exchange Offer may be directed to Intelsat Luxembourg at the link below:

Contact Investor Relations

The complete terms and conditions of the Exchange Offer, as well as the terms of the 2024 Lux Notes, are set forth in the Offering Memorandum. The Offering Memorandum will only be made available to holders who complete an eligibility letter confirming their status as Eligible Holders. Holders of 2018 Lux Notes who wish to receive a copy of the eligibility letter for the Exchange Offer may contact Global Bondholder Services Corporation (the “Information and Exchange Agent”) at 65 Broadway – Suite 404, New York, New York 10006, Attn: Corporate Actions, (212) 430-3774 (for banks and brokers) or (866) 470-4200 (for all others). Holders may also obtain and complete an electronic copy of the eligibility letter on the following website maintained by Global Bondholder Services: http://gbsc-usa.com/eligibility/intelsat_luxembourg.

Intelsat Luxembourg is making the Exchange Offer only by, and pursuant to, the terms of the Exchange Offer Materials. None of Intelsat Luxembourg, the Information and Exchange Agent, nor their respective affiliates makes any recommendation as to whether Eligible Holders should tender or refrain from tendering their 2018 Lux Notes. Eligible Holders must make their own decision as to whether or not to tender their 2018 Lux Notes, as well as with respect to the principal amount of the 2018 Lux Notes to tender. The Exchange Offer is not being made to any holders of 2018 Lux Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction.

This press release does not constitute an offer to purchase securities or a solicitation of an offer to sell any securities or an offer to sell or the solicitation of an offer to purchase any new securities, nor does it constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is unlawful.

About Intelsat

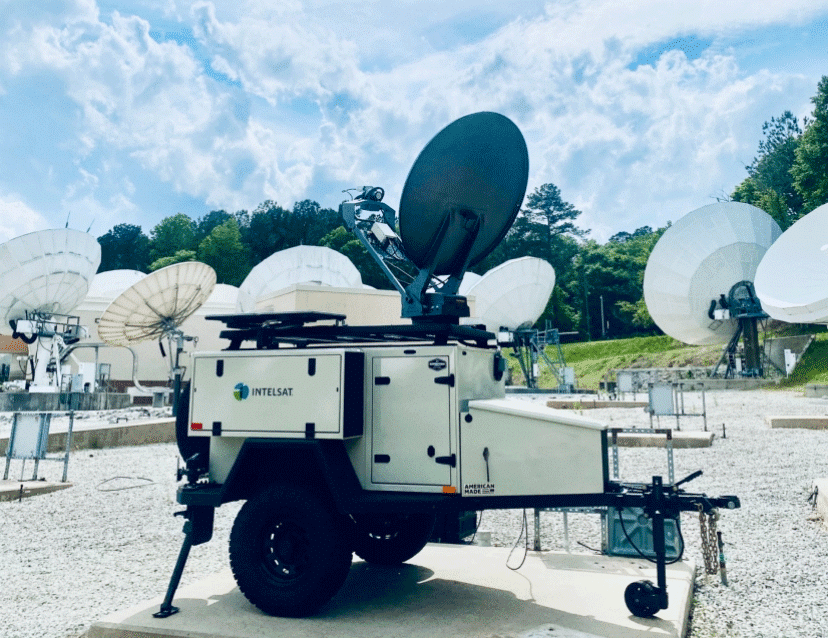

Intelsat S.A. (NYSE: I) operates the world’s first Globalized Network, powered by its leading satellite backbone, delivering high-quality, cost-effective video and broadband services anywhere in the world. Intelsat’s Globalized Network combines the world’s largest satellite backbone with terrestrial infrastructure, managed services and an open, interoperable architecture to enable customers to drive revenue and reach through a new generation of network services. Thousands of organizations serving billions of people worldwide rely on Intelsat to provide ubiquitous broadband connectivity, multi-format video broadcasting, secure satellite communications and seamless mobility services. The end result is an entirely new world, one that allows us to envision the impossible, connect without boundaries and transform the ways in which we live.

Intelsat Safe Harbor Statement

Statements in this news release, including statements regarding the Exchange Offer and the Prior Exchange Offers, constitute “forward-looking statements” that do not directly or exclusively relate to historical facts. When used in this release, the words “may,” “will,” “might,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “intend,” “potential,” “outlook,” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements and information.

The forward-looking statements reflect Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside of Intelsat’s control. Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. Known risks include, among others, market conditions and the risks described in Intelsat’s annual report on Form 20-F for the year ended December 31, 2015, quarterly report on Form 6-K for the quarters ended June 30, 2016 and September 30, 2016, and its other filings with the U.S. Securities and Exchange Commission and risks and uncertainties related to our ability to consummate the Exchange Offer or the Prior Exchange Offers.

Because actual results could differ materially from Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, assumptions and beliefs about the future, you are urged to view all forward-looking statements with caution. Intelsat does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact:

Dianne VanBeber

Vice President, Investor Relations and Corporate Communications

+1 703-559-7406

Contact Dianne